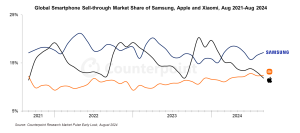

Xiaomi has achieved the #2 position in global smartphone sell-through volumes for August 2024, marking its first time in this spot since August 2021. This achievement, revealed by preliminary data from Counterpoint Research comes despite Xiaomi’s month-over-month (MoM) sales volumes remaining steady. Meanwhile, Apple experienced a seasonal decline during the same period. Xiaomi’s strong performance in 2024 underscores its status as one of the fastest-growing smartphone brands this year. What will the effect of this be on the global secondary mobile market?

Xiaomi's market resilience in 2024

In August, Xiaomi outperformed the market, particularly in regions like Latin America, where seasonal declines were counteracted by promotions-led growth. This success follows a challenging 2022 for Xiaomi, marked by supply chain issues and a tough macroeconomic environment. However, the company has implemented significant changes in its product lineup, sales strategies, and distribution channels. These adjustments have fueled its resurgence, with Xiaomi posting consistent year-on-year (YoY) growth almost every month in 2024, recovering from a weak 2022 and early 2023.

A focused product and sales strategy

According to Tarun Pathak, Research Director at Counterpoint, Xiaomi’s success in 2024 can be attributed to a streamlined product strategy. “Xiaomi has adopted a leaner product strategy this year, focusing on developing one standout model per price category, rather than launching multiple devices in each segment,” Pathak said. He also noted that Xiaomi has boosted its marketing efforts, expanded into new markets, and strengthened its presence in existing ones.

One key driver of Xiaomi’s growth has been its dominance in the lower price segments, especially with budget-friendly 5G devices like the Redmi 13 and Note 13 series. These devices have gained widespread popularity in markets such as India, Latin America, Southeast Asia, and the Middle East and Africa, where demand for affordable smartphones remains high.

Competitive landscape and Apple’s seasonal decline

Xiaomi’s rise to the #2 spot is not only a result of its internal strategies but also Apple’s seasonal dip in August. Historically, August has been a slow month for Apple as customers anticipate the release of new iPhone models in September. With the upcoming launch of the iPhone 16 series, Apple is expected to reclaim its position in the global smartphone market, potentially overtaking both Xiaomi and Samsung.

Xiaomi’s success signals shifts in the global smartphone market

Xiaomi’s recent success reflects a broader trend in the global smartphone market, where competition among top brands is intensifying. As smartphones from different brands become more comparable in terms of technology and pricing, differentiation through innovative form factors (such as foldables) and advanced features, like GenAI, is becoming increasingly important. Xiaomi’s focused approach to product development and marketing has enabled it to thrive in this competitive landscape.

Impact on the secondary mobile market

Xiaomi’s rise and Apple’s temporary dip raise important questions for the global secondary mobile market, which depends heavily on unit volume and trade-ins. As the dominant player in the secondary market, Apple’s iPhone sales play a critical role in determining the supply of devices available for trade-in. With Apple falling to third place behind Xiaomi in August, is this a troubling sign for the secondary market?

In the short term, not necessarily. Current sales volumes for Apple still show a positive trend compared to previous years, meaning more Apple iPhones will likely enter the secondary market after trade-ins. However, if Apple continues to lose market share and sees a drop in overall unit volume, the secondary market could face significant challenges.

Conclusion

Xiaomi’s ascent to the #2 spot in global smartphone sales marks a pivotal moment in the industry, driven by strategic product development and market expansion. While Apple’s seasonal decline in August has allowed Xiaomi to rise, the upcoming launch of the iPhone 16 series may shift the balance once again. For the secondary mobile market, the availability of trade-in devices remains closely tied to Apple’s performance, making the next few years crucial for both the primary and secondary markets.

Market

Trade-in

Repair

Interested in the global market for used electronics?

From now on, you'll never miss a thing and can easily stay up to date with the latest developments in the secondary market. Sign up today for the newsletter from secondarymarket.news. It's filled with the latest news, trends, developments, and gossip. Stay informed and don't miss out on anything!

Daily (except on Sundays), you'll receive the latest news from the global secondary market straight to your inbox after registering. This way, you'll always stay up to date with the latest secondary market developments and trends.